In international trade, few things are as important—and as commonly misunderstood—as the Harmonized System (HS) code. For Nigerian importers, using the correct HS code determines not only how much duty you will pay but also whether your shipment will sail smoothly through customs or become delayed due to queries. As rules evolve in 2026, understanding tariff classification is now essential for avoiding penalties, revaluation, and time-wasting disputes.

1. What Exactly Is an HS Code?

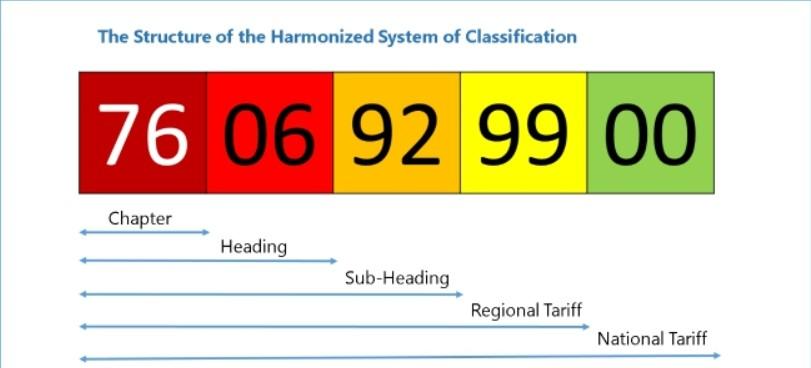

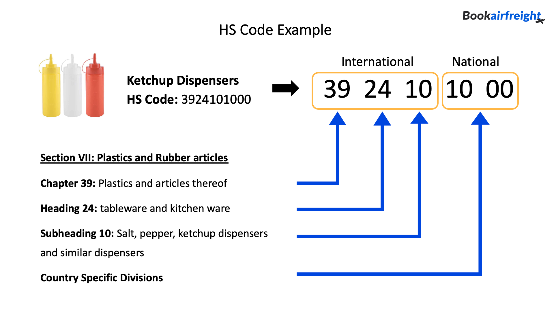

An HS code is a 6–10 digit number used globally to classify goods in international trade. It defines:

- The nature of the product

- Applicable import duties

- Whether the item requires SONCAP, NESREA, or NAFDAC certification

- Restrictions, bans, or special permits

Nigeria uses the ECOWAS Common External Tariff (CET), which means HS classifications follow a regional standard.

2. Why HS Codes Matter in 2026

Correct classification affects almost every stage of your import process, including:

- Duty and levy calculation

- Risk level assigned by customs

- Clearance time and whether physical examination is needed

- Potential fines or seizures

In 2026, Nigeria Customs is expanding the use of automated classification tools and stricter documentation verification, meaning inaccurate HS codes will be flagged faster than before.

3. How to Identify the Correct HS Code

To classify goods correctly, importers should consider:

a. Product Composition

Example:

- Plastic chair vs. metal chair — different HS codes.

b. Function and Purpose

Electronics, textiles, automotive parts, and chemicals have very defined classifications.

c. Industry Standards

Some categories, like food items or pharmaceuticals, have globally recognized HS groups.

d. Supplier Documentation

Request:

- Technical specifications

- Product catalogues

- Material breakdown

These details help avoid wrong classification.

4. Common Mistakes Nigerian Importers Make

1. Guessing HS Codes

Many importers “pick” a code based on similarity, not accuracy—this is costly.

2. Using the Supplier’s Code Without Verification

Suppliers often classify based on their own country’s tariff structure. Nigeria may categorize the item differently.

3. Wrong HS Code to Reduce Duty

Under-declaring duties using a false HS code leads to:

- Revaluation

- Fines

- Delays running into days or weeks

- Possible seizure

4. Misclassifying Mixed Goods

Mixed cargo must be declared accurately. Customs may separate items for individual classification.

5. Tools Nigerian Importers Should Use in 2026

To reduce errors, consider:

- Nigeria CET Tariff Book

- Customs duty calculators

- Freight forwarder classification guides

- AI-based classification tools

- Past customs rulings for similar products

These resources help provide clarity long before the cargo arrives.

6. The Role of Freight Forwarders

A knowledgeable freight forwarder:

- Confirms HS codes during the Form M stage

- Cross-checks documentation

- Advises on tariffs, exemptions, and special requirements

- Helps reduce clearance delays

Working with an experienced forwarder saves money and minimizes risk.

Conclusion

In 2026, accurate HS code and tariff classification will determine how smooth, fast, and cost-effective your import process will be. By using the right tools, verifying documentation, and working closely with a competent freight forwarder, Nigerian importers can avoid unnecessary penalties, reduce clearance delays, and maintain full compliance with customs regulations.